What It Means for Homeowners and Buyers

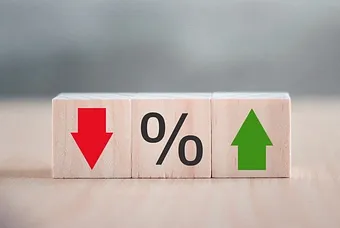

Following the positive announcement that inflation has fallen slightly from 3.8% to 3.6%, it now appears more likely that the Bank of England will cut interest rates at their next meeting in December. Commentators suggest there is now a 65% chance of a change.

Why Buyers Are Waiting for December’s Decision

Malcolm Prescott, Managing Director of award-winning West Country estate agents Webbers, says:

“In recent weeks, it is fair to say that the property market has stalled somewhat, largely because many potential buyers are waiting to see whether any changes will be announced in the forthcoming budget that may affect them. The news that inflation has fallen is certainly positive, but it is telling that there has been very little from the wider media highlighting this good-news story and that’s exactly what we need to hear!”

Seasonal Trends: What Happens in December and January

Traditionally, the housing market experiences a seasonal slowdown throughout December as people prepare for and celebrate Christmas. However, historic data consistently shows that activity picks up sharply early in the New Year. Webbers’ local agents are already speaking with home-sellers who are preparing their properties for a January launch.

Malcolm adds:

“Some agents will tell you that Boxing Day is the busiest day of the year for property searches not true! While searches do increase on Boxing Day, it’s only from a very low base. The real peak comes in late January.”

Thinking of Selling in 2026? Start Preparing Now

If you’re considering selling your home, now is the perfect time to prepare for the January surge. Speak to your local Webbers office for expert advice and a free valuation.